Biannual State of the Home Survey Continues to Find Homeowners Unprepared for Emergencies

March 29, 2018

Sourced by Business Wire https://www.businesswire.com/news/home/20180329005573/en/Biannual-State-Home-Survey-Continues-Find-Homeowners

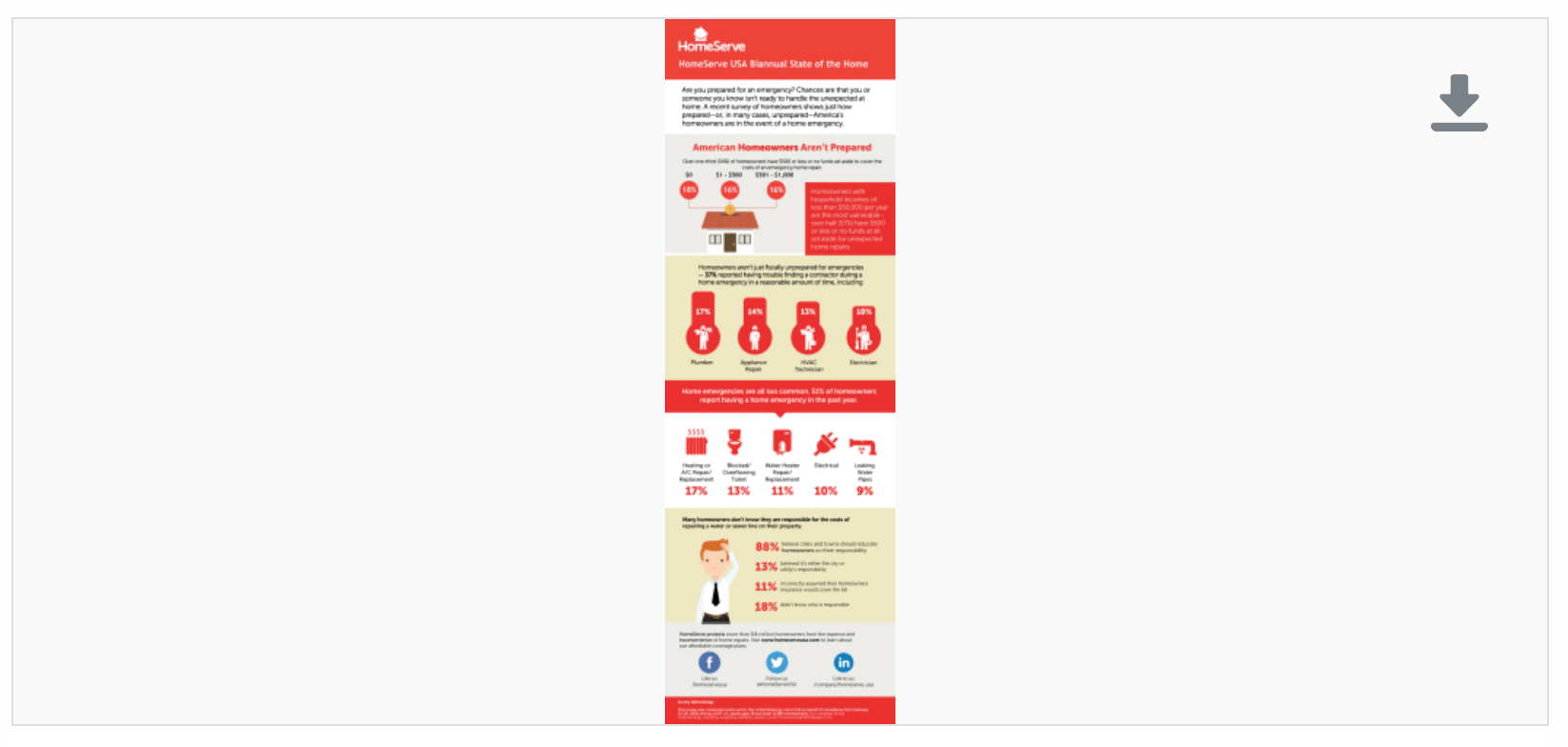

- American homeowners aren’t ready for an emergency. A third of homeowners (32 percent) have $1,000 or less set aside for home repairs, with an additional 18 percent indicating they have no savings for any kind of emergency home repair. 57 percent of homeowners with household incomes under $50,000 have $500 or less or no funds set aside for unexpected repairs.

- More than four in ten (42 percent) homeowners don’t know they are responsible for the costs of repairing a water or sewer line running to their home, either reporting they don’t know who would be responsible or believing the repair would be covered by their homeowners insurance or that the city or utility would cover it.

NORWALK, Conn.--(BUSINESS WIRE)--Many American homeowners simply are not prepared for the unexpected cost of a home emergency. This lack of preparedness is further compounded by the fact that many American homeowners do not understand what their homeowners insurance covers – or doesn’t cover. Unfortunately, this means far too many homeowners would encounter a major financial strain if faced with a home repair not covered by their insurance, such as a break in the water pipes on their property.

HomeServe USA (HomeServe), a leading provider of home repair solutions, announced these findings as part of its Winter 2018 edition of the HomeServe Biannual State of the Home Survey. The twice annual survey, now in its sixth edition, reports on the financial impact of home repairs. The survey was conducted online by Harris Poll on behalf of HomeServe from February 22–26, 2018 among 2,037 adults age 18 and older, including 1,389 who are homeowners.

The survey found that many American homeowners aren’t financially prepared for a home repair emergency. A third of homeowners (32 percent) have only $1,000 or less set aside for home repairs, while an additional 18 percent reported having no savings set aside for a repair emergency. And the findings were even more concerning for homeowners with more limited financial means. Of those homeowners with household incomes of under $50,000 a year, 57 percent reported having $500 or less or no funds at all set aside for a home repair emergency.

There’s also considerable confusion about what home repair emergencies a homeowner would be responsible for. 42 percent of homeowners didn’t know they are responsible for the costs of repairing a water or sewer line running to their home — 13 percent believed it’s either the city or utility’s responsibility, 11 percent incorrectly assumed their homeowners insurance would cover the bill, and 18 percent didn’t know who would be responsible.

“It’s easy to assume that the homeowners insurance we pay into will be there to help in any emergency repair,” said Tom Rusin, CEO of HomeServe USA. “In fact that’s not the case in all situations. Unfortunately, standard homeowners insurance policies do not cover repairs to exterior water or sewer lines that connect to the city system. If homeowners don’t take steps to proactively protect themselves, a simple leak can wind up becoming a major financial surprise.”

Emergencies are much more common than people assume — 51 percent of homeowners reported having a home repair emergency just in the past year. Further, 37 percent of homeowners reported having trouble finding a contractor for emergency repairs in a reasonable amount of time, with plumbers topping the list (17 percent).

“During a home emergency, homeowners want to know that help is on the way. It can be incredibly frustrating and even scary when homeowners have to wait for a contractor while water backs up into their house or they go for an extended period of time without heat,” said Rusin. “HomeServe takes its commitment to customers very seriously, and we pledge to be there when home emergencies arise. With just a single call, night or day, HomeServe makes the repair process easy. Further, our customers also have the peace of mind that they won’t be left with a huge repair bill that will strain their finances.”

For more information on available repair service plans, visit www.HomeServeUSA.com.

Survey Methodology

This survey was conducted online within the United States by Harris Poll on behalf of HomeServe from February 22-26, 2018 among 2,037 U.S. adults ages 18 and older (1,389 homeowners). This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact homeserve@hkstrategies.com.

About HomeServe

HomeServe USA Corp. (HomeServe) is a leading provider of home repair solutions serving 3.4 million customers across the US and Canada under the HomeServe, Home Emergency Insurance Solutions, Service Line Warranties of America (SLWA) and Service Line Warranties of Canada (SLWC) names. Since 2003, HomeServe has been protecting homeowners against the expense and inconvenience of water, sewer, electrical, HVAC and other home repair emergencies by providing affordable repair coverage and quality local service. As an A+ rated Better Business Bureau Accredited Business, HomeServe is dedicated to being a customer-focused company supplying best-in-class repair plans and other services to consumers directly and through over 500 leading municipal, utility and association partners. For more information about HomeServe, a 2017 Connecticut Top Workplace winner and recipient of eighteen 2018 Stevie Awards for Sales & Customer Service, please go to www.homeserveusa.com. To connect with HomeServe on Twitter and Facebook, please visit www.twitter.com/homeserveusa and www.facebook.com/HomeServeUSA.

Contacts

HomeServe USA

Myles Meehan, 203-356-4259

Myles.Meehan@homeserveusa.com

or

Hill+Knowlton Strategies for HomeServe USA

Merrie Leininger, 775-846-0664

homeserve@hkstrategies.com